Startup funding during Covid-19: the outlook for tech companies

Global venture capital funding has already dropped by 20% since the onset of the crisis in December 2019. The emergence of COVID-19 shattered expectations for the year, adding pressure to previous trends and concerns, such as Brexit and the US-China trade tensions. How can founders cope and what action can be taken today?

At a time when coronavirus puts the gig economy to the test for the first time ever, human behavior during the pandemic baffles AI models and physical and social isolation become the norm, most tech startups are struggling with shifting valuations.

What past crisis can teach us about startup funding

COVID-19 shockwaves are triggering an economic contraction, with businesses around the world currently working to cope with its ramifications. VC investment is expected to slow significantly over the next quarter as a follow-up to the reduced number of deals in Q1 2020.

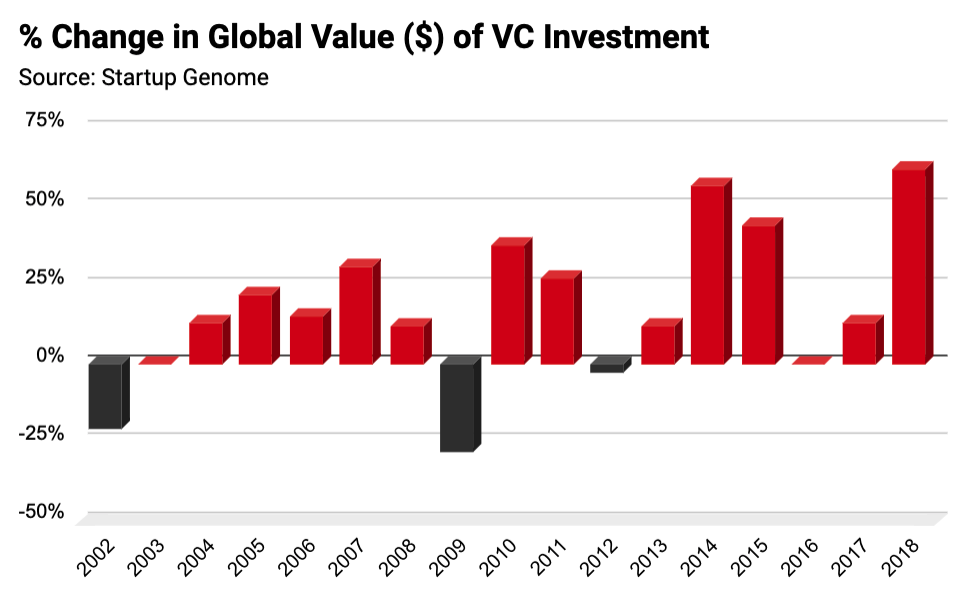

As such, it might be helpful for founders to take some pointers from historical analogies. During the Dot-Com Bust (2000-2001) and the Great Recession (2007-2009), global VC investments dropped by 21.6 and 29.3 percent respectively, over the ensuing twelve months.

VC Investment historical crisis

When projected to our current context, this would be equivalent of a decline of up to $86.4 billion in global VC investments. After the past two recessions, global VC investments took one and three years respectively to recover to pre-contraction level.

An uncertain follow-up to a rocky start

Despite global political and economic uncertainty, including the UK’s exit from the European Union and the US-China trade war, in 2020 VC investment got off to a positive start. Although the deal number kept its downwards trend, the overall funding amount was higher than in the last quarter of 2019 and about the same as Q1 2019.

US VC Deals and Investments

In the US, autonomous mobility company Waymo raised $2.25 billion, while in Europe, UK-based Revolut led fundraising with a $500 million round, and recently Bolt (Uber’s rival) raised $106 M.

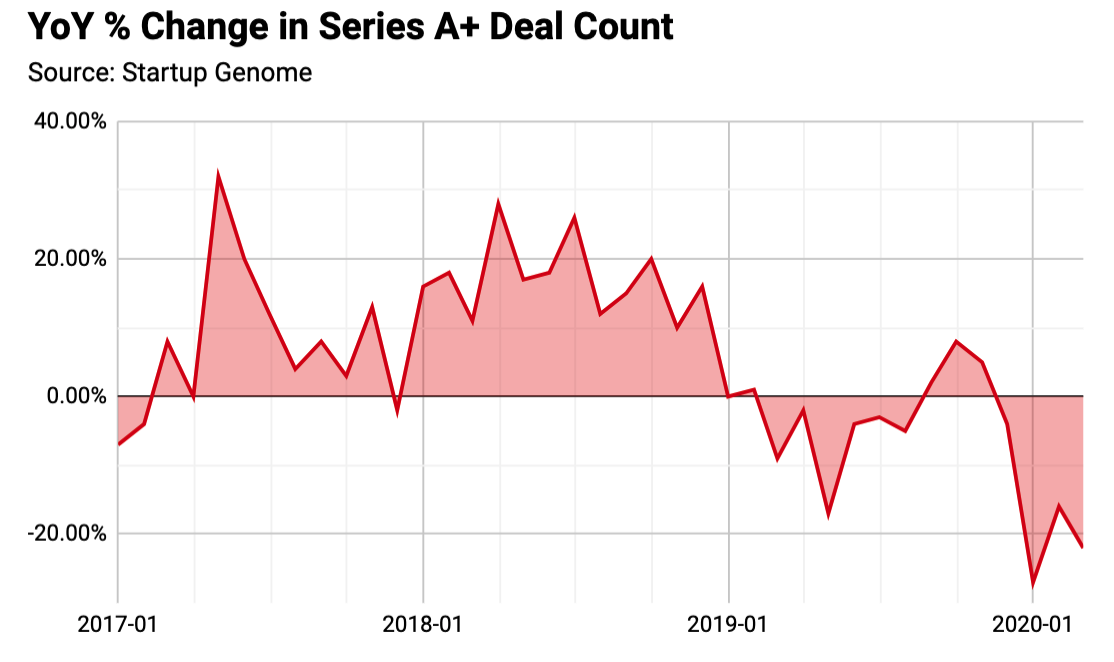

The general funding trend, however, paints a different picture, starting as far back as early 2019. Signs of trouble in the startup funding landscape became apparent after subpar performances from promising companies such as Uber and Lyft. These VC cautionary tales drove a sharper focus on transparency and profitability thus making it harder for founders to find backing.

VC deals series A decline

With the sudden outbreak of COVID-19, investors have become even more risk averse, waiting until they better understand the impact of the virus. Overall, funding rounds were down 22% in March, and valuations have also taken a hit, despite the “are VC open for business?” debate trending on twitter for the past weeks.

Capital efficiency during Covid-19 is more important than ever

In the past weeks, the global startup ecosystem has felt the impact of the Coronavirus outbreak. Compounding on the fact that 74% of startups saw declining revenues, nearly 20% of startups that had a term sheet had it pulled by investors. A sizeable share of companies were dramatically hit, with a 80% drop in revenue affecting 16% of startups.

For founders, this means that managing their capital efficiency and reducing their burn rate is now a vital part of withering the storm. 41% of startups globally have three months or less of cash runway left. For startups that have raised Series A or later rounds, 34 percent have less than 6 months worth of cash. A precarious position at a time when fundraising is difficult, with fewer funding rounds at every stage.

For some tech startups, managing burn rates means layoffs might be inevitable. Others are considering a hiring freeze. For the typical startup, finding some breathing room comes at the cost of a reduced workforce, as was the case with 74% of startups since the beginning of the crisis. On average, salaries represent 69% of startup costs (including base pay and payroll taxes), making this a key point for founders who seek to avoid testing the market and secure their valuations.

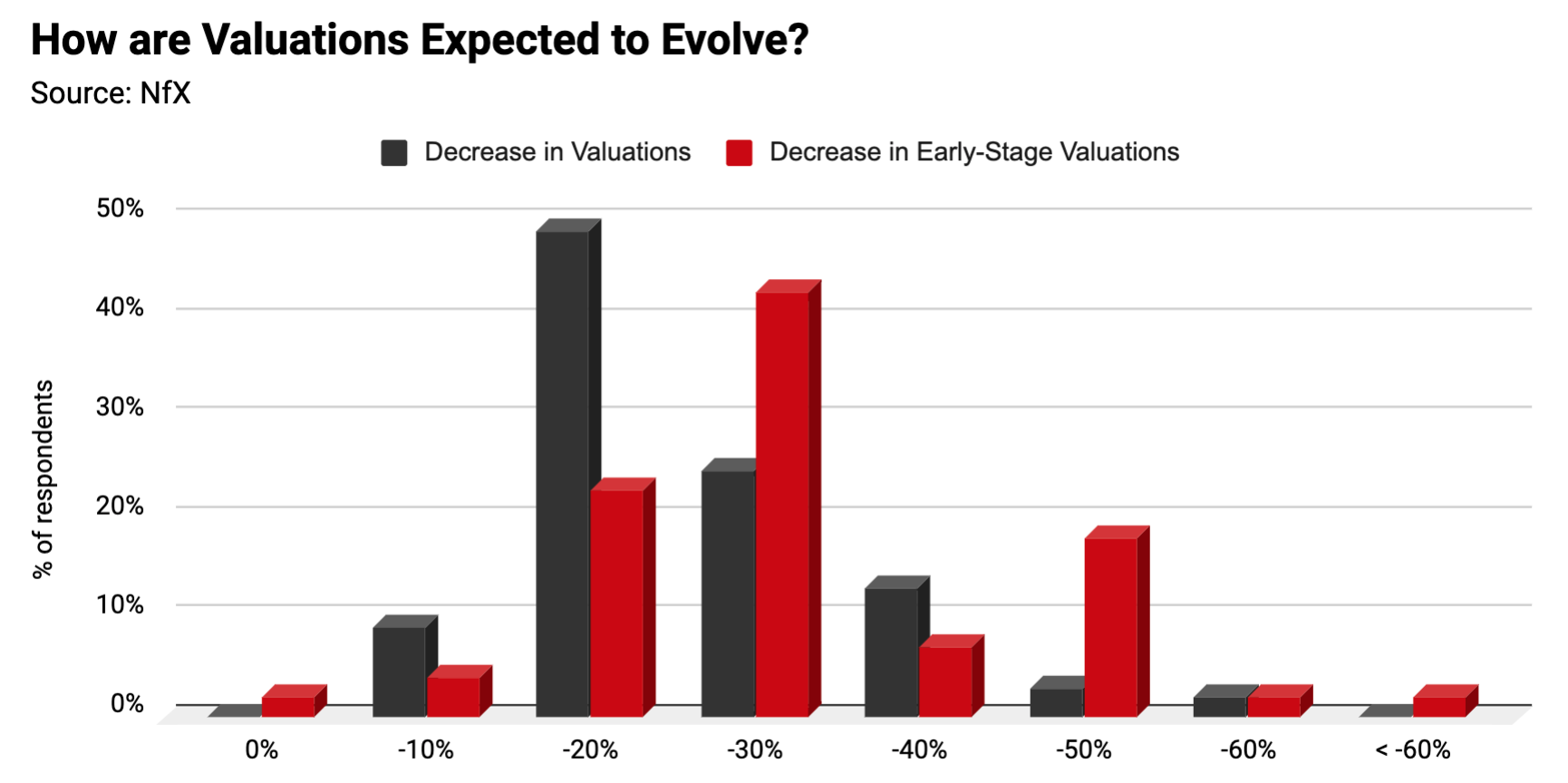

Coronavirus is impacting valuations and pushing timeframes

VC and startup sentiment surveys show that entrepreneurs are already asking for lower valuations when seeking funding. In a recent survey, around 40% of entrepreneurs said that they believe startup valuations will decline by 30% or more.

VC-backed startups Valuations cut early stage vs later stage

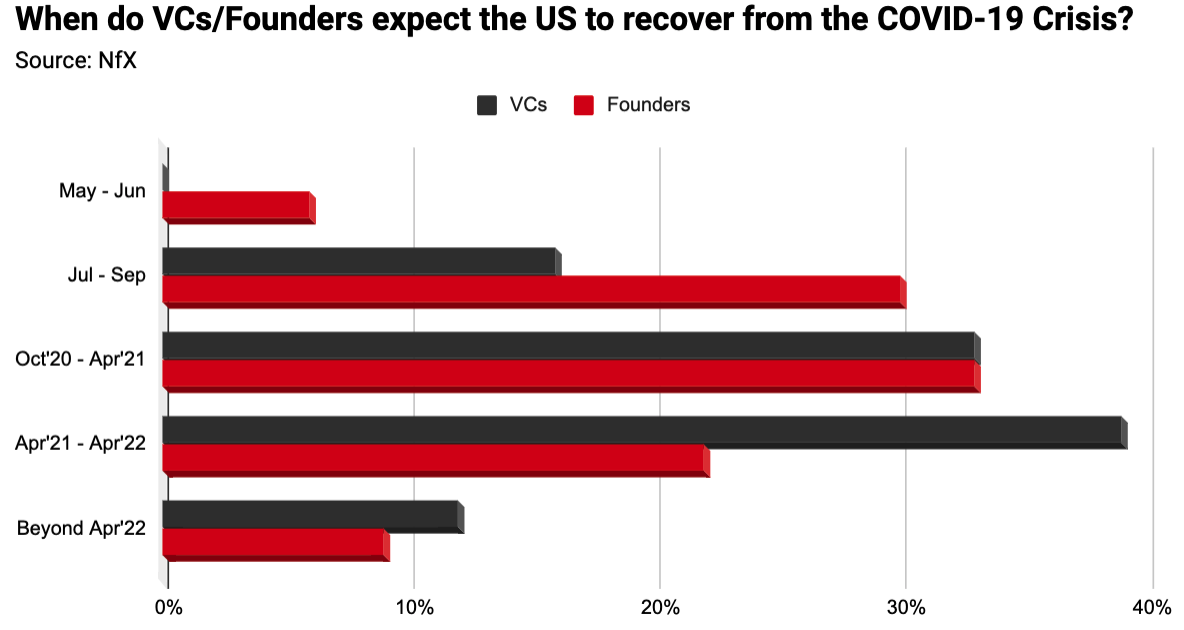

Although founders’ are generally more optimist than investors when it comes to estimating a ‘return to normality ’ timeframe, most founders and investors in the U.S. are betting on recovery no sooner than April 2021.

VCs startups Founders US COVID crisis recover

To make matters worse, upcoming VC deals are expected to involve follow-on funding within their existing portfolios. As we enter this period of uncertainty, many VCs will be focused on a ‘survival of the fittest’ strategy, meaning later stage rounds, modifying plans via reductions in the topline, headcount and burn rates.

A glimmer of hope for startups

Airbnb, Whatsapp, Uber, Slack, Pinterest, Square, and Stripe were all founded in the midst of the last crisis. And as always, crisis pose opportunities. Today, startups can access talent around the world, giving founders the opportunity to hire in markets typically outside their immediate reach.

During the past two recessions, while the total value of VC deals dropped, the number of companies getting funded still grew. Capital-efficient businesses have a higher chance of raising money following a recession, even if at a lower valuation.

The record amount of capital ready to be deployed in the next few years means that even with a more cautious approach, VC won’t reduce investment and let good startups run out of funds.

Governments around the world are helping founders through these difficult times. The UK is considering a “Runway Fund” with a convertible note scheme for companies that cannot access bank loans. Germany is offering to cover 60% of the salaries for employees reduced from full to part-time. And Denmark is covering 75% of salaries for companies that do not cut staff.

Road light hope

Looking ahead – action founders might consider today

Despite longer-term possibilities, most startups have months left in their runways, not years. Founders looking for startup funding face the risk of a down round. To avoid it, here are a few actionable pointers to consider:

For startups not able to postpone their next fundraising until 2021, when funding rounds might favor them, it’s important to master remote pitch meetings. Rapport might be harder to build over video tools so it’s important to work on storytelling and be dynamic and energetic.

Track investor interest and engagement in real-time via other founders actively raising funding. Increasing the funnel size will counteract the fact that many investors will be more cautious or move slower. Now more than usual, founders should increase their numbers - more numbers dialed, meetings attended and investors in the pipeline.

Pivoting the business model is something to consider during these changing times. Several startups in various sectors are changing the way they offer value to different customer groups during this crisis.

Capital-efficient startups are more prone to improved terms when seeking funding. As an example, the pandemic has opened the opportunity to rethink work and office spaces. Also, restructuring the workforce into distributed teams can reduce costs and make it easier to find talent.

It’s hard to grasp the extent to which the startup funding landscape has shifted in the weeks since the onset of the COVID-19 global pandemic. However, economic downturns are always times of new business creation, when entrepreneurs spot the new market opportunities.

While opinions of investors will continue to range from ‘buy-now-while-prices-are-low’ to ‘freeze-all-spending-indefinitely’, it’s important for startups to revise strategy so they can have the upper hand.

Improving capital efficiency and building up resilience is paramount. In times of uncertainty, diversification is key to mitigate risks. If people are key assets in any organization, reducing exposure to a single talent pool and country in times of restricted travel and stricter immigration laws seems the only way to go. At BRIDGE IN we are experts in restructuring and scaling tech businesses and we can help you evaluate your options with a free consultation.