Meal allowance in Portugal in 2026: New limits, taxes, and best practices

Effective January 2026, the meal allowance (subsídio de refeição) in Portugal has officially increased to €6.15 per day if paid in the payslip. That’s €0.15/day more than in 2025.

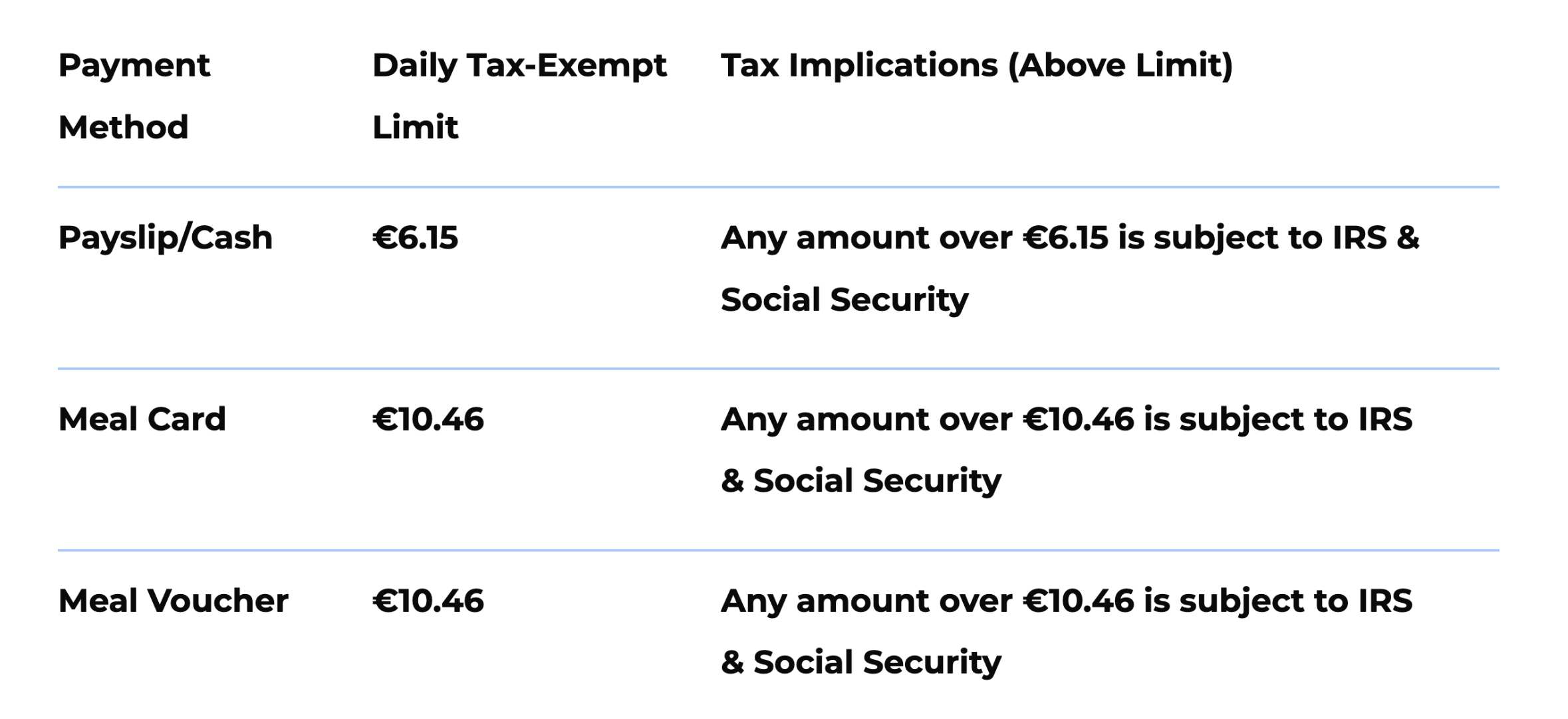

Following the new Pluriannual Agreement between the Government and Public Administration unions, this update has immediate tax implications for the private sector. Companies paying via meal card can now provide up to €10.46 per day (a 70% increase over the base limit), which is completely exempt from IRS (Personal Income Tax) and Social Security contributions.

For a standard 22-day work month, this represents a tax-free benefit of €230.12. This is yet another significant tool for attracting top talent in Portugal's competitive 2026 market.

2026 Portugal meal allowance at a glance

New meal allowance limits in Portugal in 2026

Is the meal allowance mandatory in Portugal?

Despite being one of the most common benefits in Portugal, under the general Labour Code (Código do Trabalho), the meal allowance is not mandatory in the private sector. Meal allowance is technically a “social benefit” and part of the tax-free benefits in Portugal.

However, if you have employees or are planning on hiring in Portugal in 2026, your company must pay a meal allowance if:

The meal allowance is explicitly written into the employee's employment contract.

It is required by a Collective Bargaining Agreement (CBA) relevant to your industry.

Increase in meal allowance in Portugal in 2026—Why it matters?

Why the increase in meal allowance in Portugal matters

The rise from €6.00 to €6.15 might seem minor (after all, it is just a 15-cent increase per day), but its impact is multiplied by the “70% Rule” in the IRS Code. Because the Government uses the civil service allowance as the benchmark for tax exemptions, the “magic number” for meal cards and vouchers jumped from €10.20 to €10.46 per day.

This allows for higher net “take-home” pay for employees without increasing the company's (TSU) tax burden.

Rules for remote work and part-time

As of 2026, the principle of non-discrimination remains strict in Portuguese labor law:

Remote Work (Teletrabalho): If your office-based staff receives a meal allowance, your remote workers are legally entitled to the same amount as the office-based employees.

Part-Time Workers: This depends on the number of hours they work every day. If an employee works at least 5 hours per day, by law, they must receive the full daily allowance (same as working 8 hours per day). If they work fewer than 5 hours per day, the value is calculated proportionally to their weekly working hours.

Meal allowance in cash vs. card – Which option is most tax-efficient

Meal allowance in cash vs. card

Let’s say you want to give an employee a €11.00 daily allowance instead of €10.46.

Paid in Cash: You pay taxes (IRS and Social Security) on €4.85 (the amount above €6.15).

Paid via Meal Card: You only pay taxes on €0.54 (the amount above €10.46).

The meal card remains the most efficient way to put money back into your employees' pockets while keeping your payroll costs in Portugal optimized. The following are the most well-known meal cards in Portugal:

Need help with payroll in Portugal?

Staying on top of all the changes introduced not only every year but throughout the year can be complex. And if you have to manage payroll compliance across different jurisdictions, it is even harder.

Do you have employees in Portugal, Spain, or Italy and need help with managing payroll compliance or simply learning more about Portuguese payroll tax limits? Our team is here to help you and ensure all payroll updates are implemented smoothly and accordingly.

Feel free to reach out!

Frequently Asked Questions (FAQ)

1. Will the meal allowance increase automatically for employees?

Short answer: No. The newly introduced increased meal allowance (subsídio de refeição 2026) applies only to the maximum tax-free limit. Employees will benefit only if their employer chooses to update the meal allowance amount on the meal card, voucher, or payroll.

2. Is the meal allowance mandatory in the private sector?

Technically, no. The Portuguese Labour Code does not mandate a meal allowance. However, it is mandatory if it is stipulated in the employee’s contract or required by a Collective Bargaining Agreement (CBA). In 2026, offering this benefit is considered a standard best practice for reputable employers.

3. Are remote workers (Teletrabalho) entitled to the allowance?

Yes. Under Portuguese law, remote workers must have the same employee benefits and rights as office-based employees. If your on-site team receives a meal allowance, your remote team is legally entitled to it as well.

4. Can I pay more than the tax-exempt limit?

Yes, you can pay any amount you choose. However, any cent above the limits (€6.15 for cash or €10.46 for card) will be taxed as regular salary, meaning both the employee and employer will pay IRS and Social Security on that excess portion.

5. Is the allowance paid during vacations or sick leave?

No. The meal allowance is strictly paid for days actually worked. It is not due during holidays, vacations, or justified/unjustified absences.