Brexit impact on business: Should you relocate your company to the EU?

Companies are looking into relocation as a way to mitigate the risks of a hard Brexit. As Amsterdam and Frankfurt grab headlines, Portugal has been quietly preparing. Here’s why companies should consider it for their next move.

The UK has now exited the EU and is currently in a transition period until the 31st December 2020. Both sides still need to work out the rules for their new relationship.

As Brexit impact on business is still uncertain, companies of all sizes have already decided not to wait and are choosing to relocate to the mainland ahead of future crisis.

While competition increases between major hubs such as Amsterdam and Frankfurt, Portugal has been preparing to welcome stability-starved UK businesses since 2017.

Relocations, closures, layoffs, stockpiling, staff relocation and plans put on hold – firms bracing for Brexit have spent hundreds of millions of pounds on contingency planning. According to the UK’s own National Audit Office, as of 2020, even for UK Government Departments, the cost of preparing for Brexit had already topped £ 4.4 bn.

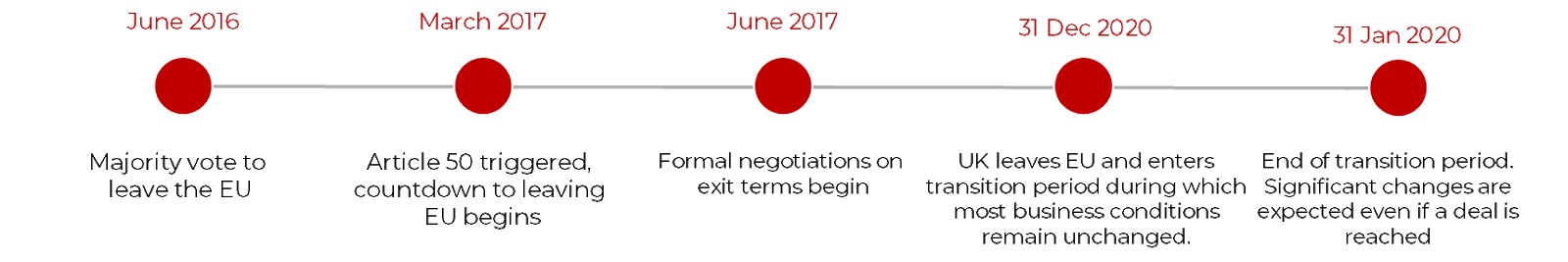

Brexit timeline: an ongoing saga

In a referendum on 23 June 2016, the UK electorate voted to leave the EU. Following the announcement, negotiations began to decide how the movement of goods, services, people and capital across the UK/EU borders would be processed.

Up to Feb 1st, 2020, Britain was still a full member of the EU’s single market and customs union, which enables its member states to function as a single trading area with no tariffs or border checks, and with a combined VAT system. On that day, the UK formally left the EU with a deal called the “withdrawal agreement” which covered areas like citizens' rights, how to stop checks along the Irish border and the UK's financial settlement.

Between 31 January 2020 and 31 December 2020, the UK is in a transition period, designed to give both sides breathing space to negotiate their future relationship. During this time, most business conditions remain unchanged.

What happens after the transition period?

If no deal is reached when transition ends, the UK will automatically drop out of the EU's main trading agreements, the single market and the customs union.

If a trade deal is reached, it would not eliminate all checks - so UK businesses will need to prepare. Significant changes are expected, requiring additional steps for business to trade goods, services, transfer personal data and move people in and out of the EU/EEA.

Businesses must therefore prepare now for the UK’s new relationship with the EU which will take effect on 1 January 2021.

Here’s a summary of Brexit key moments so far:

Brexit impact on business, from Logistics to GDPR

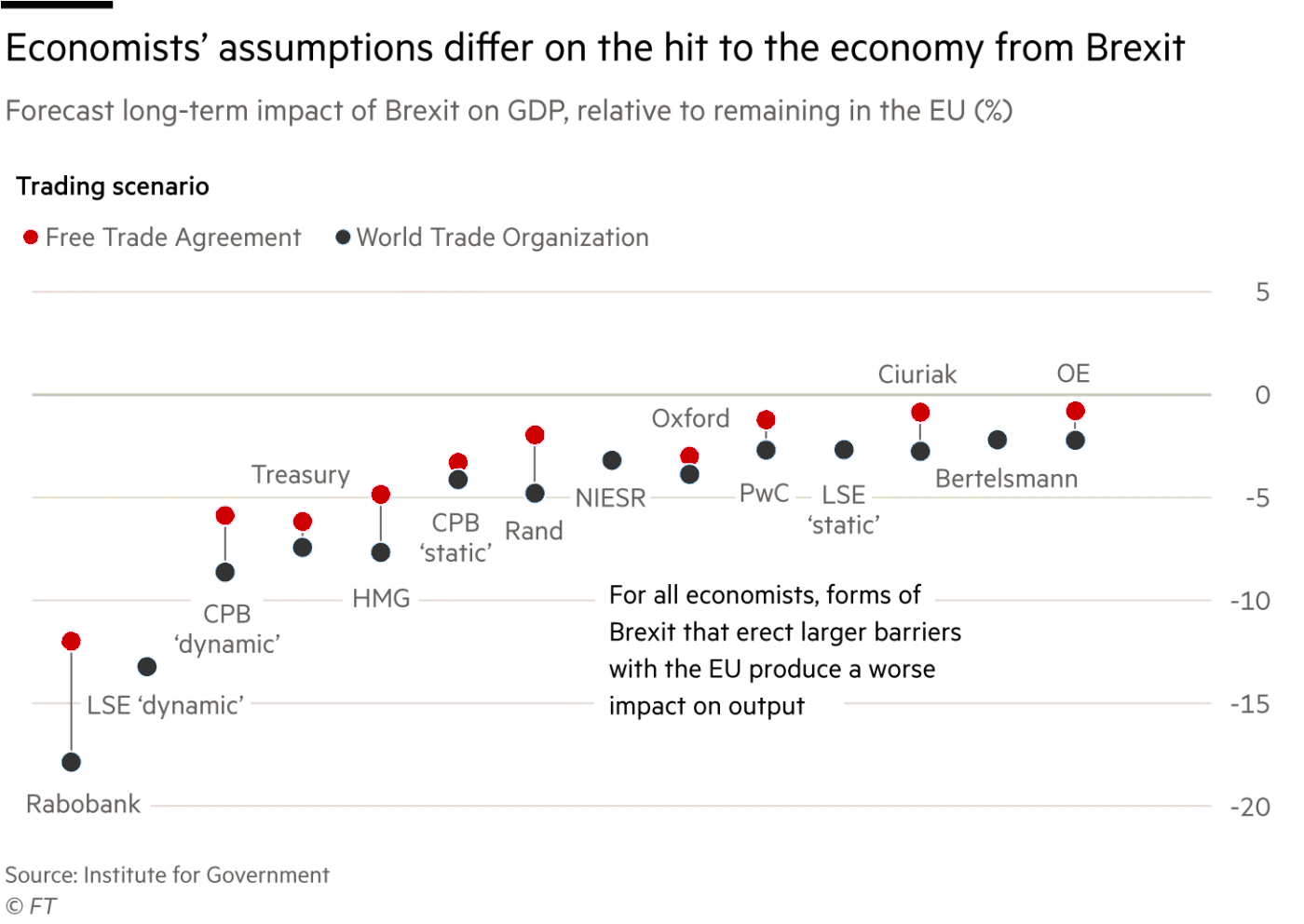

Although there is consensus around the uncertainty that Brexit will bring upon Businesses, economists’ assumptions differ on its hit on the UK economy.

In any case, unlike other crises, Brexit-related uncertainty has been growing since its onset and markets have had a hard time shrugging off its impact.

Deal or no deal, these are some key factors that are likely to disrupt the EU/UK relation as we know it:

Import and export of goods and services to and from EU countries will now need to include associated VAT payments and maybe even customs’ duties.

Employment regulation will impact businesses which recruit employees cross-borders the most. EU regulations currently help internationally mobile employees pay social security contributions in only one Member State. In the event of a “no deal” Brexit, these regulations will cease to have effect. Companies employing UK nationals working in other countries, or EU nationals working in the UK may need to revise their rights and healthcare coverage, with the situation varying depending on the country they’re working in, with many countries still lacking legislation.

Business travel could be affected by new immigration checks. Transportation and logistics are likely to be disrupted at least to some extent.

The flow of data to and from the EU, protected by the GDPR, will need to be reanalysed. The General Data Protection Regulation applies to all companies based in the EU and those with EU citizens as customers. It has an extraterritorial effect, so non-EU countries are also affected. This means that even though the UK will be leaving the EU, it will still need to comply with the GDPR. The UK faces the prospect of being regarded as a third country when it exits the EU. As a result, the transfer of personal data from organisations within the EU to other organisations in the UK will be subject to strict data transfer rules, as set out by the EU General Data Protection Regulation (GDPR).

The UK’s insurance sector is one of the world’s largest, managing investments of £1.8 trillion and employing 300,000 individuals. The insurance sector however could be one of the most impacted due to the level of regulation and interconnection between the UK and EU financial systems, and the risk that millions of policies signed pre-Brexit could become invalid. The possibility remains that firms operating in the UK and EU could be subject to two distinct regulatory regimes, lending to a greater compliance burden over time.

UK financial services firms will no longer be able to provide the full range of regulated activities from the UK into the EU after the transition period ends. In order to continue providing these services, UK financial services firms will have to either move certain operations to existing presences within the EU, establish a branch or a subsidiary within the EU or they may rely on the individual European member states’ regimes to mitigate the impacts on their European customers and continue trading with the EU without tariffs.

Copyright, IP, Qualifications and other relevant matters are still up for debate, which contributes to the atmosphere of uncertainty that is bad for business.

After the transition period ends, the freedom of movement between the UK and EU Member States will end.

As Brexit rolls on, it’s worth having a look at where companies are relocating and why.

Brexit impact on businesses has led some big names to trigger their contingency plans

Brexit is estimated to have already accounted for a 6% reduction in investment in the first two years after the referendum, with employment also around 1.5% lower.

Moving forward, businesses expect Brexit to reduce their sales by around 3% with further negative effects on exports, unit costs, labor costs, and financing costs.

BREXIT BUSINESS IMPACT – POST EXIT ESTIMATES BY BUSINESS LEADERS AFTER 1ST JANUARY 2021 (%)

In total, worst-case scenario estimates point to around 430.000 jobs being lost in the process.

These factors have already proven too relevant to ignore for many UK companies.

Here a few examples of corporations leaving the UK in search of stability.

Panasonic moved its European headquarters from London to Amsterdam because of Brexit. According to Panasonic’s CEO Laurent Abadie “Panasonic had been considering the move for 15 months, because of Brexit-related concerns such as access to free flow of goods and people.” Sony is following the same path. And these tech giants are not alone: between 2018 and 2019 a total of 300 companies moved their headquarters from the UK to the Netherlands, creating 1.923 jobs and investments worth 291 million euros in the process.

JP Morgan is moving assets worth more than 200 Billion euros to Frankfurt. In a statement, the US’s largest bank by assets said the move was part of its “strategy to continue to serve European-based clients seamlessly from major cities across the continent including Frankfurt, Luxembourg and Dublin”. JPMorgan will initially transfer sales people, followed by an as-yet undetermined number of traders, depending on the timing and substance of the UK’s departure from the EU. The same goes for Unicredit and UBS, also relocating to the German financial center, amid uncertainty around the nature of the UK-EU regulatory relationship after Brexit.

AIG is shifting some operations to Luxembourg. AIG Europe Ltd Chief Executive Officer Anthony Baldwin explained why: “the great advantage of the restructuring route we have chosen is that it will give clients certainty that whatever the other unknowns of Brexit for their businesses, their European insurance coverage has been Brexit-proofed”. Acting on the same concerns , the UK broadcaster Discoverym, Hiscox and Liberty Insurance are following suit.

Dublin has also attracted some large banking players such as Barclays.

The city which hosts Web Summit, Lisbon is becoming a center for several UK companies. Startups and large corporations alike continue to expand into Portugal and the country is reaping the economic benefits. Foreign companies from different parts of the globe have been settling in, pre and post-Brexit: Google has opened a support centre creating 500 tech jobs for skilled workers, as well as BMW, Daimler, Volkswagen, BNP Paribas, Natixis, Cloudflare, Bosch and Siemens, Euronext, Revolut, among many others. UK companies are also moving to Portugal. As per businesses coming from the UK, 22 British companies from various fields of activity have relocated to Portugal since 2017, making for 26 investment projects, worth around 460 million euros and 1400 jobs.

Portugal offers a stable and secure base in Europe for companies, and quality of life for expats

There are around 20,000 British citizens living in Portugal and the number has been gradually increasing on account of Brexit uncertainties.

Here are few reasons why more and more companies of all sizes are relocating to Portugal:

Portugal promotes a tolerant, open and safe society and is ranked one of most peaceful countries in the world.

It’s a mere 2-hour flight from the UK and it’s in the same time zone.

The Portuguese government has determined a 10-year tax break on most foreign-sourced income, including dividend, interest, rental and pension income, as well as real estate capital gains, under the so-called Non-Habitual Resident (NHR) tax status, which is granted to new residents.

Lisbon in particular, is bustling with 49 co-working spaces and shared offices such as LACS, Heden, IDEIA, and Cowork Lisboa, to name a few. The Beato Creative Hub, a 35,000 m² mega campus can hold up to 3000 jobs.

The use of English in business is widespread, resulting in being easy to find multinational operations with Portuguese, Spanish, British and German people where English is used as the main language. Uber, for example, chose Portugal to support all sales operations across the EMEA region because it has a multilingual workforce. In a survey to more than 20.000 expats from 182 nationalities, Portugal came out first as the favorite European place to live and work for expats, thanks to its hours of overall quality of life measured in leisure offers, gastronomy, affordability, healthcare system, family life and ease of settling in.

Portugal has one of Western Europe's lowest cost of living.

In 2018, the UK climbed to the top position on Portugal's source of foreign direct investment, ahead of China, Netherlands and Spain, with an investment flow of £711 million (€896 million), a growth of 18% vs. the previous year.

The Portuguese Government has been preparing for different scenarios and developed a series of contingency plans, to minimize economic disruptions. The Government has been engaging with the major economic and trade sectors from Portugal that rely on the UK, with specific measures around technical and financial support developed.

Should companies consider Portugal for their next ‘move’?

While the main effects from Brexit remain unclear, businesses expect Brexit to disrupt their sales as well as investment, employment, and productivity.

By establishing a presence in European Union companies can eschew the bulk of Brexit impact on business. They also safeguard the flow of data, goods, services and people between the UK and the EU - making Brexit a seamless transition for customers. Portugal in particular, is an open, safe, polyglot society from which companies of all sizes can support their EMEA operations.

If you are thinking of expanding your operations to Europe by setting up a company in Portugal, we can help you through the whole process. Book a call today.